Reguli E-Factura - Adaugare

- Achiziții şi logistică

- Cumpărări

- Configurare

- Reguli E-Factura

- Adaugare

- Reguli E-Factura

- Configurare

- Cumpărări

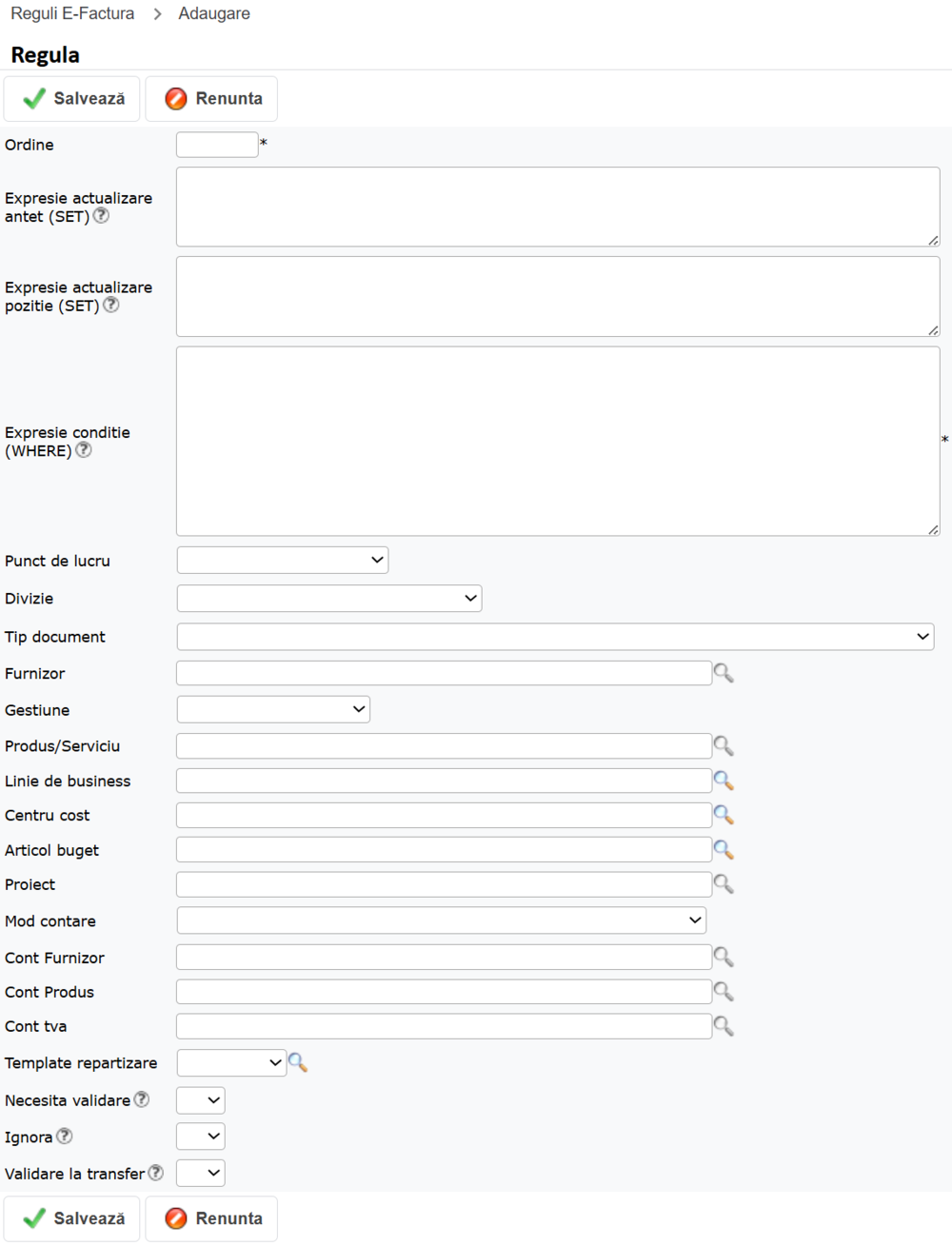

Din aceasta interfata se pot defini reguli prin care se modifica modul standard de inregistrare a e-facturilor respectiv modul standard de transfer al e-facturilor in Facturi furnizori.

Se pot defini reguli care sa impacteze urmatoarele:

- Punct de lucru

- Divizie

- Tip document

- Furnizor

- Gestiune

- Produs/Serviciu

- Linie de business

- Centru cost

- Articol buget

- Proiect

- Mod contare

- Cont Furnizor

- Cont Produs

- Cont tva

- Template repartizare

- Necesita validare:se poate selecta una din optiunile: Da, Nu. Daca se completeaza Da in acest camp, facturile care indeplinesc conditiile din expresie vor necesita validare inainte de a putea fi transferate in meniul Facturi furnizori. In modul standard (daca nu se completeaza nici-o regula cu valori in acest camp) e-facturile se insereaza deja validate.

- Ignora:se poate selecta una din optiunile: Da, Nu. Daca se completeaza Da in acest camp, facturile care indeplinesc conditiile din expresie se vor prelua ca ignorate in lista de e-facturi. E-facturile care au completata bifa Ignora, nu se vor transfera in Facturi furnizori (vor fi ignorate la transfer in Facturi furnizori).

- Validare la transfer: se poate selecta una din optiunile: Da, Nu. Daca se bifeaza acest camp, facturile care indeplinesc conditiile din expresie, la transferul in meniul Facturi furnizori se vor importa validate. In modul standard e-facturile se transfera in Facturi furnizori in starea nevalidat. Suplimentar fata de reguli, se poate configura transferul ca facturi validate in Facturi furnizori si prin filtrul ascuns ValidareFacturiPreluate.

In campul Expresie actualizare antet (SET) se poate completa o formula de tip SQL prin care se poate actualiza un camp din antetul E-facturii la preluarea din SPV si/sau la prelucrarea ulterioara. Exemplu de expresie:

In campul Expresie actualizare pozitie (SET) se poate completa o formula de tip SQL prin care se poate actualiza un camp din pozitia E-facturii la preluarea din SPV si/sau la prelucrarea ulterioara. De exemplu urmatoarea formula seteaza in explicatiile pozitiei explicatia transmisa deja in xml de furnizor la nivel de linie factura iar in cazul in care aceasta nu este trimisa in xml de furnizor, se preia denumirea produsului din xml: Observatii = ISNULL(NULLIF(LTRIM(RTRIM(LineObservations)),''),Product)

Campul Expresie conditie (WHERE) este un camp obligatoriu. In el se completeaza o formula de tip SQL prin care se specifica conditiile de identificare a documentelor asupra carora sa se aplice setarile configurate prin acea regula. Atunci cand se doreste ca setarile regulii sa se aplice la toate e-facturile, se completeaza: 1=1 Urmatoarea conditie specifica sa se aplice regulile doar la pozitiile care contin in Descriere textul "mere": ProductDescription LIKE '%mere%'

Campurile care pot care pot fi referite in formula Expresie conditie (WHERE) sunt urmatoarele (in paranteza apare specificata calea din xml):

- DocId

- Supplier (cac:AccountingSupplierParty/cac:Party/cac:PartyName/cbc:Name)

- SupplierPartner (cac:AccountingSupplierParty/cac:Party/cac:PartyLegalEntity/cbc:RegistrationName)

- FiscalCode (cac:AccountingSupplierParty/cac:Party/cac:PartyLegalEntity/cbc:CompanyID)

- DocNumber (cbc:ID)

- DocDate (cbc:IssueDate)

- DueDate (cbc:DueDate)

- InvoicePeriodStartDate (cac:InvoicePeriod/cbc:StartDate)

- InvoicePeriodEndDate (cac:InvoicePeriod/cbc:EndDate)

- InvoicePeriodDescriptionCode (cac:InvoicePeriod/cbc:DescriptionCode)

- DocObservations (cbc:Note)

- DocumentCurrencyCode (cbc:DocumentCurrencyCode)

- InvoiceTypeCode (cbc:InvoiceTypeCode)

- OrderReference (cac:OrderReference/cbc:ID)

- ContractReference (cac:ContractDocumentReference/cbc:ID)

- DespatchDocumentReference (cac:DespatchDocumentReference/cbc:ID)

- SupplierUnitCountryCode (cac:AccountingSupplierParty/cac:Party/cac:PostalAddress/cac:Country/cbc:IdentificationCode)

- SupplierUnitCountrySubentity (cac:AccountingSupplierParty/cac:Party/cac:PostalAddress/cbc:CountrySubentity)

- SupplierUnitLocality (cac:AccountingSupplierParty/cac:Party/cac:PostalAddress/cbc:CityName)

- SupplierUnitAddress (cac:AccountingSupplierParty/cac:Party/cac:PostalAddress/cbc:StreetName)

- SupplierUnitGLN (cac:AccountingSupplierParty/cac:Party/cac:PartyIdentification/cbc:ID)

- ClientUnitName (cac:AccountingCustomerParty/cac:Party/cac:PartyName/cbc:Name)

- ClientUnitCountryCode (cac:AccountingCustomerParty/cac:Party/cac:PostalAddress/cac:Country/cbc:IdentificationCode)

- ClientUnitCountrySubentity (cac:AccountingCustomerParty/cac:Party/cac:PostalAddress/cbc:CountrySubentity)

- ClientUnitLocality (cac:AccountingCustomerParty/cac:Party/cac:PostalAddress/cbc:CityName)

- ClientUnitAddress (cac:AccountingCustomerParty/cac:Party/cac:PostalAddress/cbc:StreetName)

- DeliveryLocality (cac:Delivery/cac:DeliveryLocation/cac:Address/cbc:CountrySubentity)

- DeliveryCountryCode (cac:Delivery/cac:DeliveryLocation/cac:Address/cbc:CountrySubentity)

- DeliveryCountrySubentity (cac:Delivery/cac:DeliveryLocation/cac:Address/cac:Country/cbc:IdentificationCode)

- DeliveryAddress (cac:Delivery/cac:DeliveryLocation/cac:Address/cbc:StreetName)

- DeliveryDate (cac:Delivery/cbc:ActualDeliveryDate)

- PaymentMeansCode (cac:PaymentMeans/cbc:PaymentMeansCode)

- BankAccount (cac:PaymentMeans/cac:PayeeFinancialAccount/cbc:ID)

- TotalBaseAmount (cac:LegalMonetaryTotal/cbc:LineExtensionAmount)

- TotalVATAmount (cac:TaxTotal/cbc:TaxAmount)

- LineNumber (Invoice/cac:InvoiceLine/cbc:ID)

- Quantity (Invoice/cac:InvoiceLine/cbc:InvoicedQuantity)

- UnitCode (Invoice/cac:InvoiceLine/cbc:InvoicedQuantity/@unitCode)

- LineObservations (Invoice/cac:InvoiceLine/cbc:Note)

- Product (Invoice/cac:InvoiceLine/cac:Item/cbc:Name)

- ProductDescription (Invoice/cac:InvoiceLine/cac:Item/cbc:Description)

- SupplierProductCode (Invoice/cac:InvoiceLine/cac:Item/cac:SellersItemIdentification/cbc:ID)

- BuyerProductCode (Invoice/cac:InvoiceLine/cac:Item/cac:BuyersItemIdentification/cbc:ID)

- EANProductCode (Invoice/cac:InvoiceLine/cac:Item/cac:StandardItemIdentification/cbc:ID)

- ClassifiedTaxCategory (Invoice/cac:InvoiceLine/cac:Item/cac:ClassifiedTaxCategory/cbc:ID)

- VATPercent (Invoice/cac:InvoiceLine/cac:Item/cac:ClassifiedTaxCategory/cbc:Percent)

- TaxScheme (Invoice/cac:InvoiceLine/cac:Item/cac:ClassifiedTaxCategory/cac:TaxScheme/cbc:ID)

- PriceAmount (Invoice/cac:InvoiceLine/cac:Price/cbc:PriceAmount)

- LineBaseValue (Invoice/cac:InvoiceLine/cbc:LineExtensionAmount)

- LineCurrencyCode (Invoice/cac:InvoiceLine/cbc:LineExtensionAmount/@currencyID)

Campuri

- Ordine

- Expresie

- Punct de lucru

- Divizie

- Tip document

- Furnizor

- Gestiune

- Produs/Serviciu

- Linie de business

- Centru cost

- Articol buget

- Proiect

- Mod contare

- Cont Furnizor

- Cont Produs

- Cont tva

- Template repartizare

- Necesita validare

- Ignora

- Validare la transfer